Borrow advance loans up to $75 to avoid hefty overdraft fees. In this post, however, we will address challenges facing Dave customers on finding dave app contacts, be it phone number, support ticket, physical address or social channels. read on to learn more.

Dave is meant to help you avoid overdraft charges by offering interest-free cash advances that are automatically reimbursed on your next payday. However, you can just borrow up to $75, so it won’t be much help if you need to cover a more substantial expense.

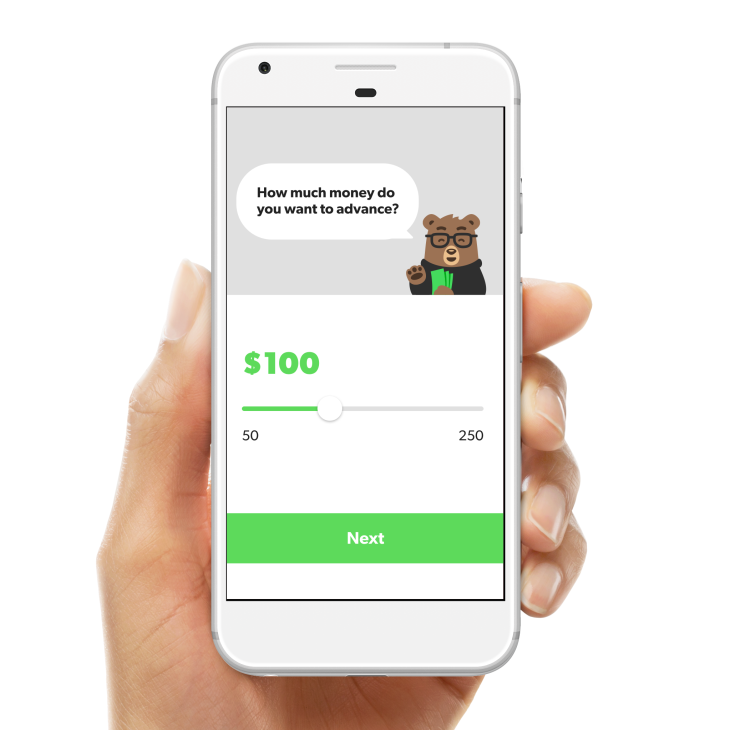

How does Dave work?

Dave is a pay advance mobile app that allows you to borrow cash up to $75 when you are at risk of overdrawing your bank account. It is free to borrow — there is no interest or fees — though you will be on the lock for a $1 monthly membership charge. You can request an advance salary with Dave as often as you would like — provided your last payment has fully cleared and your bank account is not overdrawn by more than $75.

To get started with Dave, you need to download the app to your mobile device. Dave only enables you to have one device per account, and your Dave account can just be connected to one bank account at ago.

Maximum withdrawal limit: $75

Cost: $1 monthly company fee

Turnaround: Up to three days for regular delivery, and less than eight hours for express delivery

With Dave app, you have two delivery alternatives — standard or express. The standard alternative takes up to three working days to deliver your advance cash to your checking account but is available for free to use as a member. The express option can be transferred to your debit card within eight hours but will require a small fee of just$4.99.

Review Of Dave app

The Dave app is a popular mobile banking app that helps users avoid overdraft fees and manage their finances. With over 10 million downloads on the Google Play Store, the app has become a go-to option for people looking to take control of their money.

One of the biggest selling points of the Dave app is its no-fee banking. The app doesn’t charge any monthly maintenance fees, overdraft fees, or ATM fees. Additionally, the app allows users to withdraw cash from over 32,000 ATMs nationwide, making it easy to access money when needed.

Another helpful feature of the Dave app is its budgeting tools. Users can create a budget within the app and track their spending in real-time. The app also offers insights into spending habits and provides suggestions on how to save money.

The app also offers a feature called “Dave advances,” which allows users to borrow up to $100 without any interest or credit checks. This can be a helpful option for those who need a small loan to cover unexpected expenses.

One downside of the Dave app is that it requires users to have a steady paycheck in order to be eligible for some of its features. The app requires users to have at least two direct deposits into their account each month in order to qualify for the no-fee banking and Dave advances.

Overall, the Dave app is a great option for people looking to take control of their finances and avoid expensive banking fees. With its budgeting tools, no-fee banking, and cash advance options, the app can help users stay on top of their finances and avoid financial pitfalls.

Does Dave have any income requirements?

While Dave app doesn’t verify your credit score, it does require you to meet some income qualifications to borrow:

Proof of consistent income. You will need to show at least two direct deposit paychecks to your bank account from your employer.

Extra money in your bank account. Dave needs to see proof that you have some cash left over in your bank account after you pay those regular bills.

How repayments work with Dave

You will pay Dave back the day you get paid, although smaller advances may be due on Friday after you borrow the loan. To make things simpler, Dave automatically deducts your payment from your bank account. However, if you have the cash sooner, you can constantly make a manual payment.

The only time you will pay back more than you borrow is when you choose the express delivery option or decide to tip. Given that you keep up with your monthly membership fee, you will not have to worry about paying any interest at all or late fees like with payday loans.

ADDITIONAL PROGRAMS AVAILABLE TO DAVE USERS

Dave app is more than a pay advance mobile app. When you link your bank account, Dave app can observe your transaction history and then predict when a bill may leave you in the negative. This helps guard you against overdraft fees before they occur.

Moreover, if you need a little more to get by, Dave is there with a small, fee-free advance to help you till your next paycheck.

Read also; List of best loan apps in US-top payday apps for ios and android

Dave Contacts-Phone number and messaging platforms

Do you have any queries or issues with Dave app? Worry not. Here are the Dave app contacts- phone number, address and popular support channels to get your issue resolved as fast as possible.

Address;

1265 South Cochran Avenue

Los Angeles, CA 90019

United States

Phone; 844-358-3283

Support ticket(Recommended channel): https://support.dave.com/hc/en-us/requests/new

Alternative channel: Twitter handle